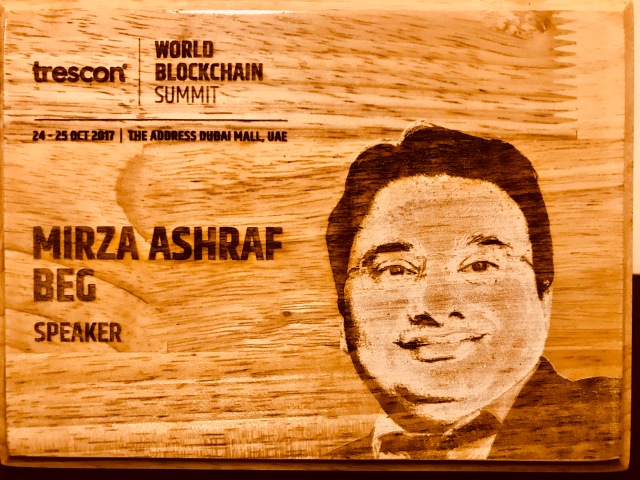

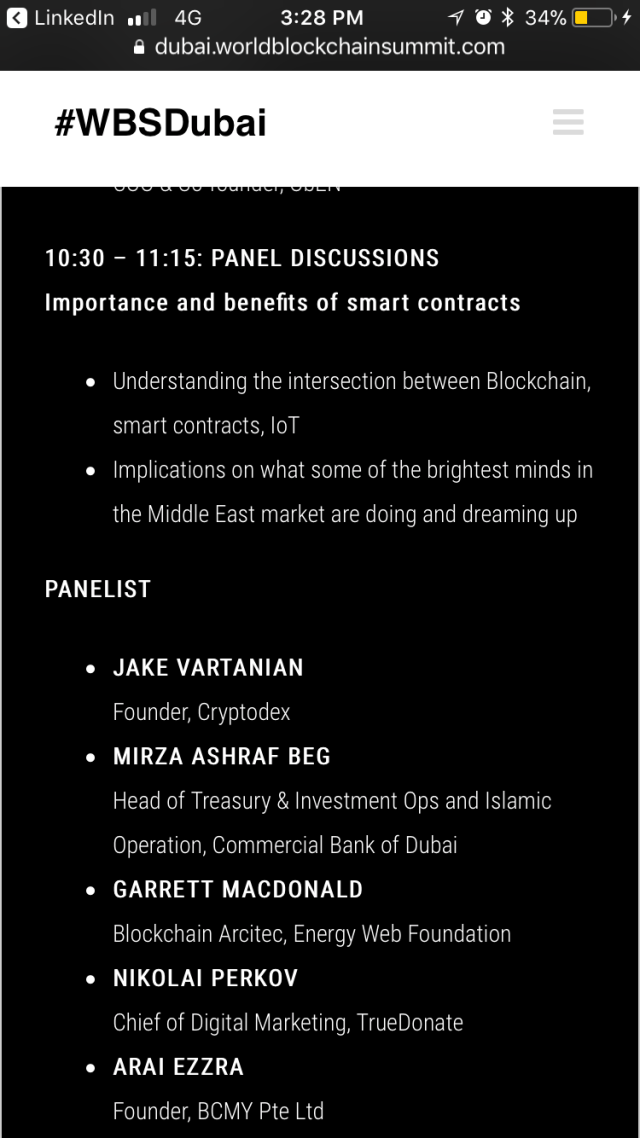

Speaking at World Blockchain Submit-Dubai. The Address-Dubai Mall.Speaking at World Blockchain Submit-Dubai. The Address-Dubai Mall.

Mirza Ashraf Beg @ DubaiMirza Ashraf Beg @ Dubai 0 Comments 12:00 am

Read Time:5 Second

https://www.youtube.com/watch?v=OthnRHWsflI&feature=share

https://www.dubai.worldblockchainsummit.com/agenda/

Share this:

- Click to share on X (Opens in new window) X

- Click to share on Facebook (Opens in new window) Facebook

- Click to share on Tumblr (Opens in new window) Tumblr

- Click to email a link to a friend (Opens in new window) Email

- Click to print (Opens in new window) Print

- Click to share on WhatsApp (Opens in new window) WhatsApp

- More